SaveUp- Simplifying Fintech App Experience

Goal-Based Personal Finance Management App

B2C

Fintech

UX/UI

App

Responsive Website

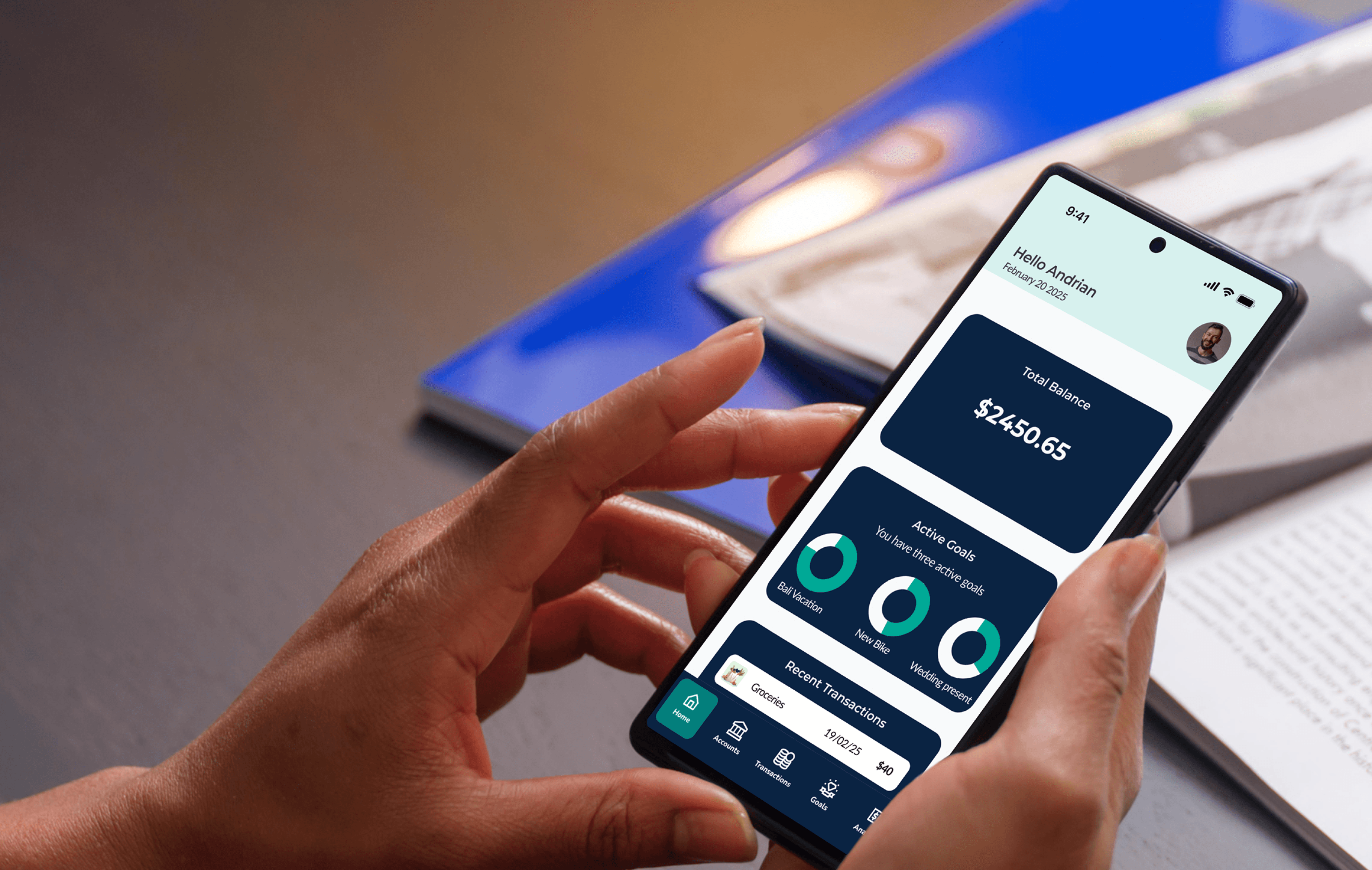

SaveUp is a personal finance management app that combines goal-based savings with intuitive expense tracking to help users achieve their financial dreams.

Planning finances can be challenging for many and the app addresses these by providing a motivating, visual approach to saving for specific goals while maintaining awareness of spending habits.

My role- UI/UX Designer

Responsibilities

User research, Ideation, Interface design, Prototyping, Usability testing

User testing showed a 35% engagement jump, driven by seamless face login, bite-sized savings goals, and visualisation tools (e.g., custom goal images). Combined with automatic transaction tracking and cash-expense logging, the app balances simplicity with holistic financial oversight to sustain user commitment.

Challenge

「 We don't lack money, we lack financial awareness. Most people don't fail at saving because they can't—they fail because they can't see the connection between today's spending and tomorrow's dreams. 」

33% of Europeans have less than one month's income in savings,

leaving them vulnerable to financial emergencies.

(Source: ING International Survey on Savings, 2021)

43% of European households report being unable to face unexpected financial expenses,

with significant variations across countries - from 23% in Sweden to over 60% in Greece.

(Source: Eurostat, 2023)

Key Objectives

With its intuitive design, personalised savings strategies, and real-time progress tracking, SaveUp empowers users to save smarter, spend wisely, and turn their financial goals into reality.

Key objectives include

Goal-focused approach

Prioritises saving for dreams, not just budgeting.

Seamless integration

Combines savings and expense tracking in one app.

Personalisation

Tailored savings strategies and insights.

Easy accessibility

Quick, smooth login experience making the app accessible.

User Research

「 The numbers about financial literacy are concerning, but my user research revealed something even more significant—

People don't lack the desire to save, they lack the tools that make saving emotionally rewarding. 」

Hypothesis

Users will find SaveUp’s personalised approach and visual progress tracking more motivating and easier to use, leading to higher engagement and long-term financial success.

My research included

- Online survey with 20 participants

- 5 in-depth interviews with adults across different income brackets

- Competitive analysis of 2 leading finance apps

Key Findings

Meet Emma- Our User

Emma on the day her salary is credited and on the end of the month

How Can We Help Emma?- Ideation

Emma represents our primary user—someone with financial goals and adequate income, but struggling with consistency and emotional connection to their savings journey.

Emma's story helped me understand her needs and thereby formulated the main question-

「 How can we help Emma balance her finances without having to deprive her of her little joys? 」

Financial management isn't about deprivation or cutting joy from your life- it's about creating harmony between today's experiences and tomorrow's dreams.

Opportunities

Reducing Friction

Easy log in and Simplify expense tracking- automate categorization.

Allow manual input when needed.

Visualizing Progress

Our research showed that abstract numbers fail to motivate consistent saving behavior. Users need to see tangible progress toward concrete goals.

Connecting Daily Decisions to Long-term Goals

Helping users understand the impact of small daily purchases on their larger financial goals.

Emotional Reinforcement

Creating moments of celebration and acknowledgment for savings milestones,

no matter how small.

User Flows

Possible navigations once the user logs in

I sketched multiple user flows to visualize ideas quickly. My focus at this stage is to diverge first, converge later- explore possibilities. Here are some early sketches of the app screens .

The initial designs went through several user tests to ensure we have a friendly and scalable user experience. Here are some unique features of SaveUp.

Quick login with face ID

A quick and secure log in feature with face recognition making the app easily accessible to the user. A smooth, enjoyable login experience sets a positive tone for the rest of the app.

When users associate the app with ease and security, they’re more likely to return regularly and develop a habit of saving.

Adding a transaction manually

While transactions made via cards and linked bank accounts are automatically tracked, managing hard cash expenses can often slip through the cracks.

SaveUp ensures that adding cash transactions is intuitive and hassle-free with a simple 4-step process.

SMART goals

Many a times goals end up being vague. SaveUp provides a solution by using the SMART goal framework.

SMART financial goals would help users create more effective savings plans.

For example, instead of "save for a vacation," a SMART goal would be "save $3,000 for a trip to Spain by June 2026" - which is specific, measurable, achievable (assuming the user's income allows it), relevant to their desires, and has a clear timeframe.

Visualising progress

Without visual reminders, saving intentions easily fade against immediate spending temptations. Visualising progress transforms invisible financial goals into tangible, ever-present reminders that keep objectives front and center in daily decision-making.

「 Out of sight, out of mind. 」

Positive Reinforcements

These reinforcements build momentum, making each saving decision easier than the last and establishing long-term financial habits that persist even when motivation temporarily wanes.

「 Acknowledging milestones, no matter how small. 」

Key Takeaways

Seamless user experience

The face recognition login and intuitive goal-setting flow make the app easy to use, encouraging consistent engagement.

Behavioural nudges

Breaking savings goals into weekly chunks and providing motivating messages helps users stay on track and develop consistent savings habits.

Visualisation and Engagement

Allowing users to upload images for goals makes them more tangible and motivating.

Displaying active goals and progress on the homepage keeps users engaged and informed.

Comprehensive Tracking

Automatically tracking card and bank transactions while providing an easy way to log cash expenses ensures users have a complete picture of their finances.

Future Iterations

Enhanced Personalisation

Use AI to analyze spending patterns and suggest personalized savings goals or budgeting tips.

Gamification

Introduce badges, streaks, or rewards for consistent savings or achieving milestones.

Advanced Analytics

Provide insights and trends on spending habits, such as:

"You spend 20% more on dining out this month."

"You’re on track to save 10% more than last month."

Integration with Financial Tools

Allow users to link investment accounts or loan accounts for a holistic financial overview.

Integrate with bill payment services to automate and track recurring expenses.

Voice Commands

Introduce voice-based transaction logging (e.g., "Add €50 for groceries").