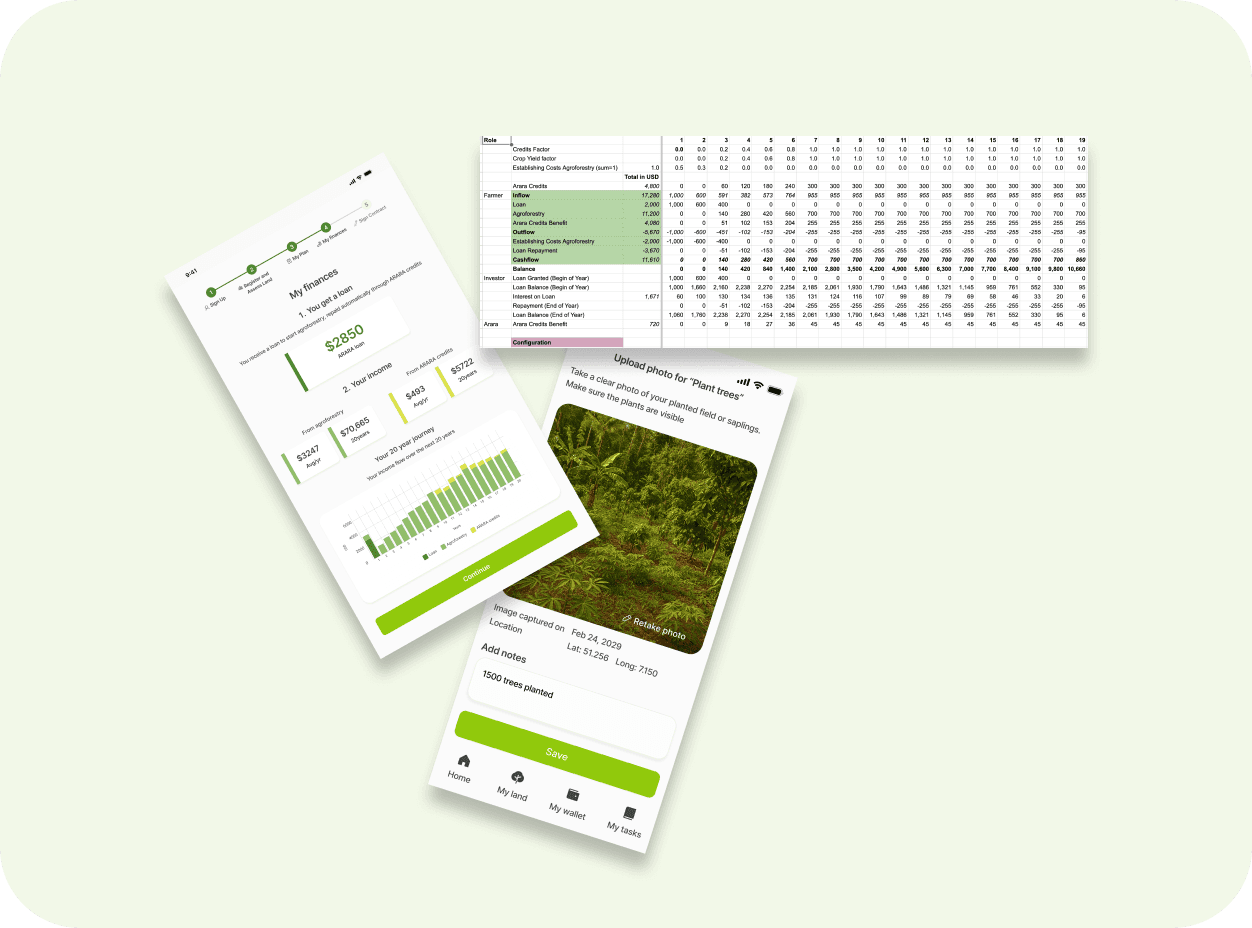

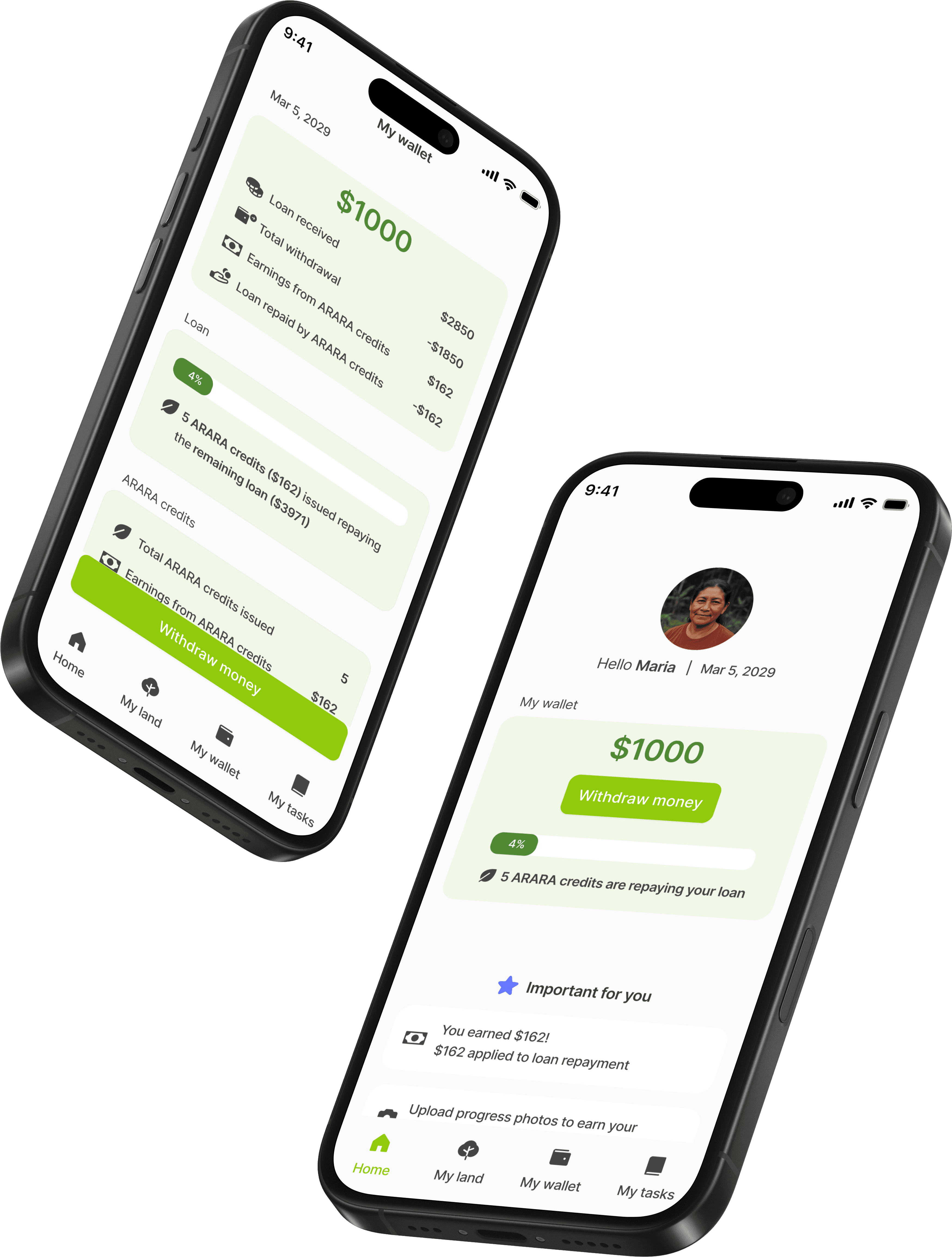

Environmental data lived in one spreadsheet, financial projections in another, verification status tracked manually

No unified view existed to show how these interconnected

Skepticism about "greenwashing"

In climate finance, trust is everything. Investors have been burned by projects that promised carbon offsets but failed to deliver verified results

ARARA needed to prove their verification processes were rigorous.

Short window to make an impression

At COP30, investors would evaluate dozens of projects. Dense reports and slideshows wouldn't cut it

ARARA would have minutes, not hours, to communicate their value proposition

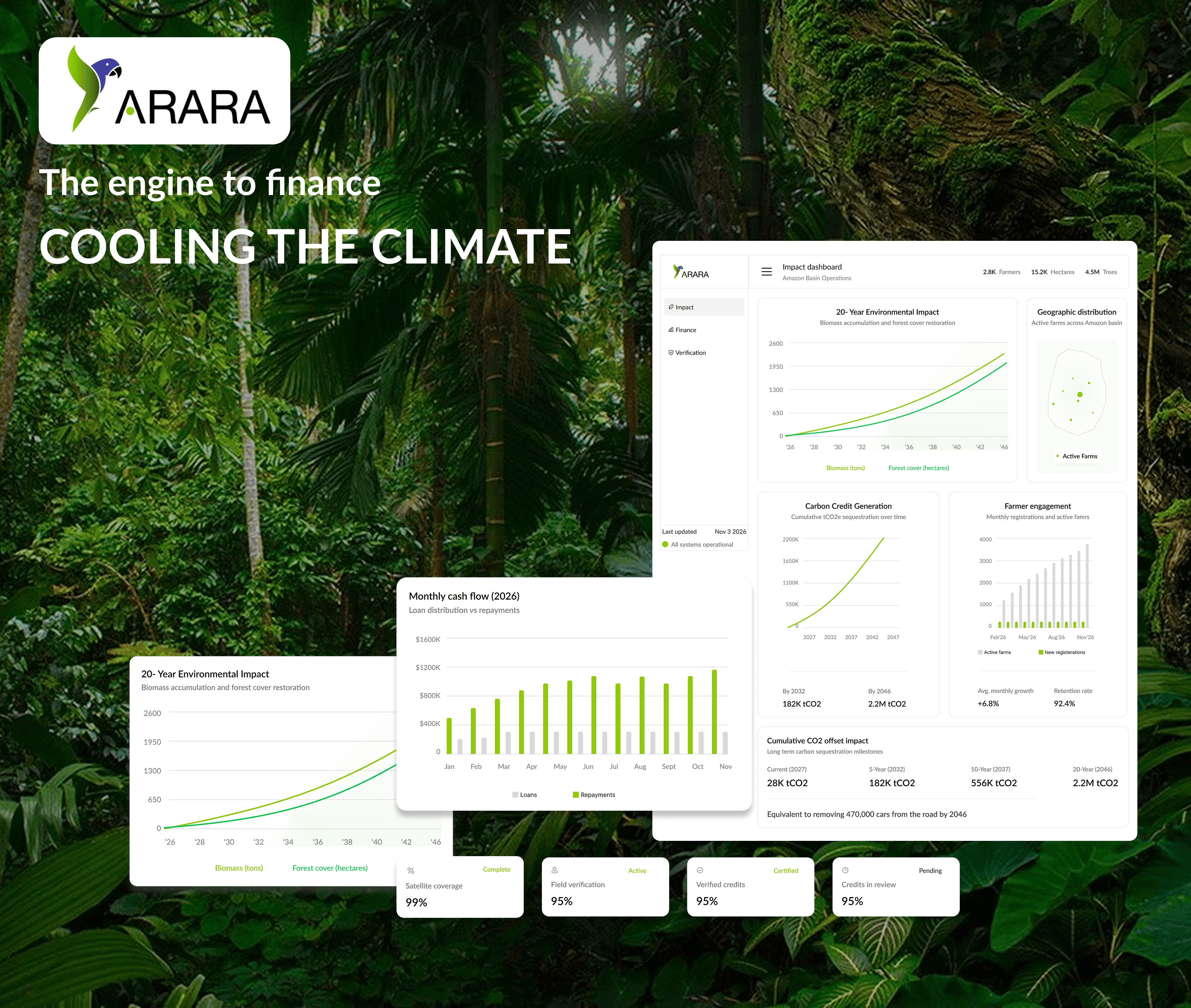

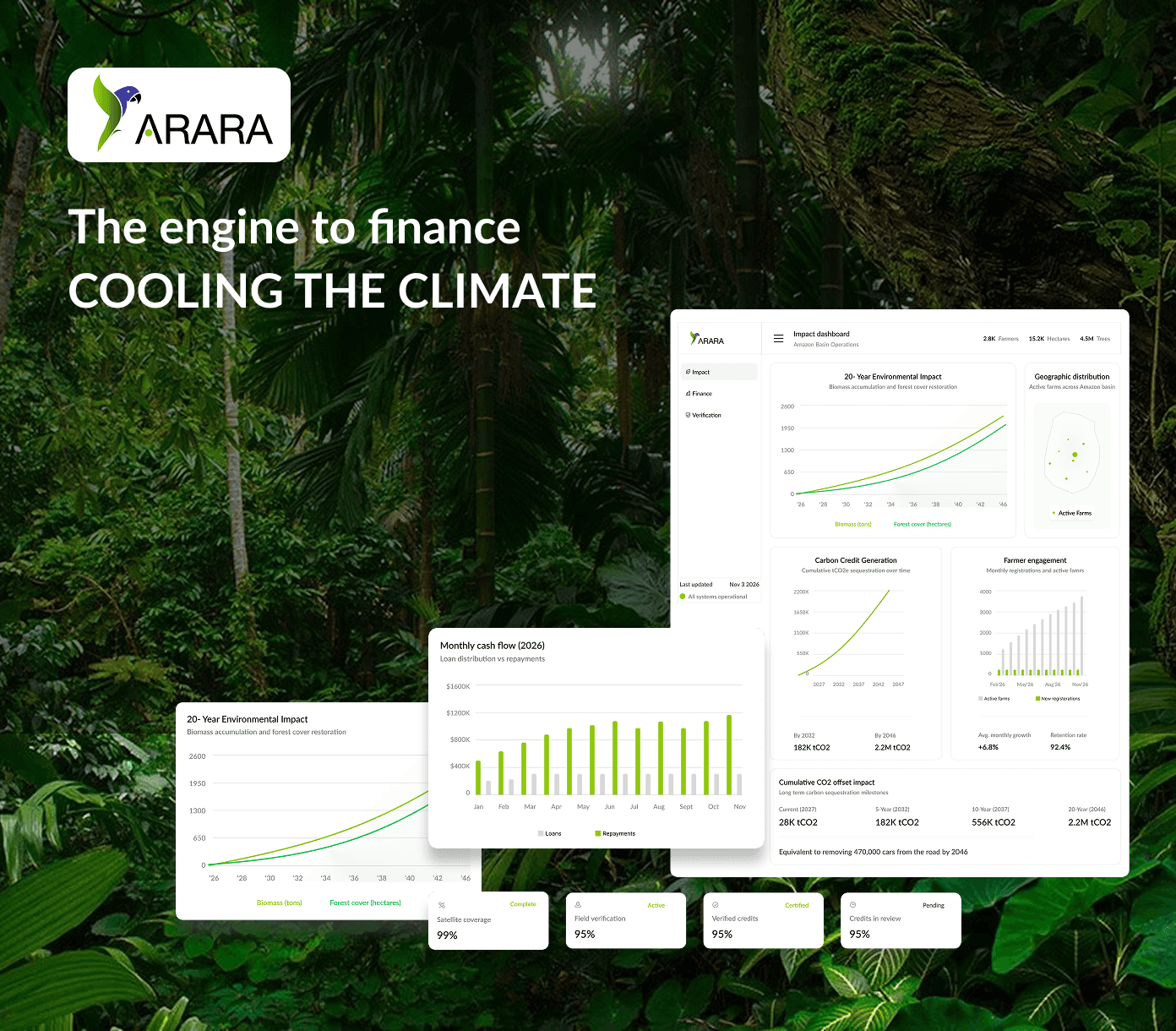

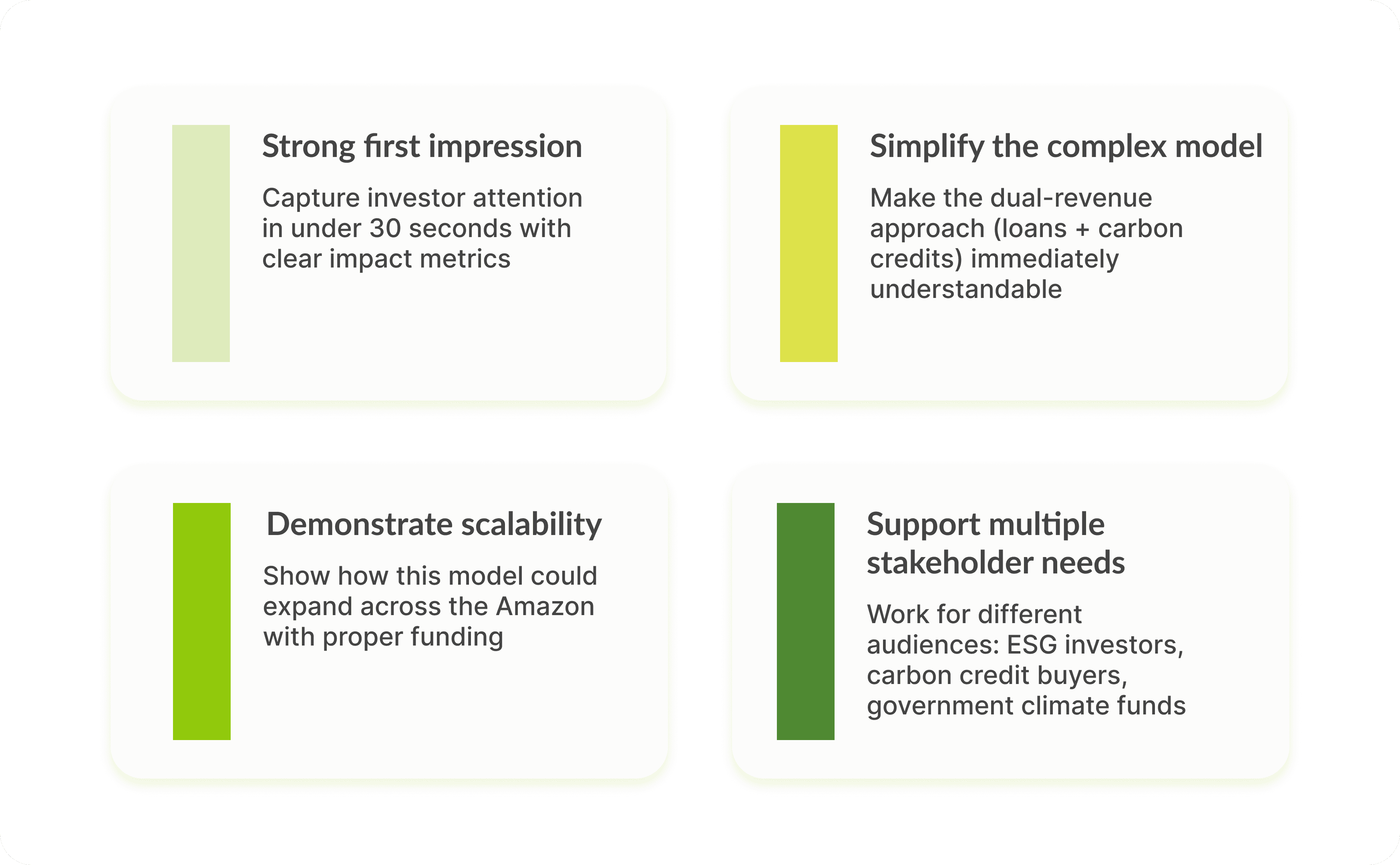

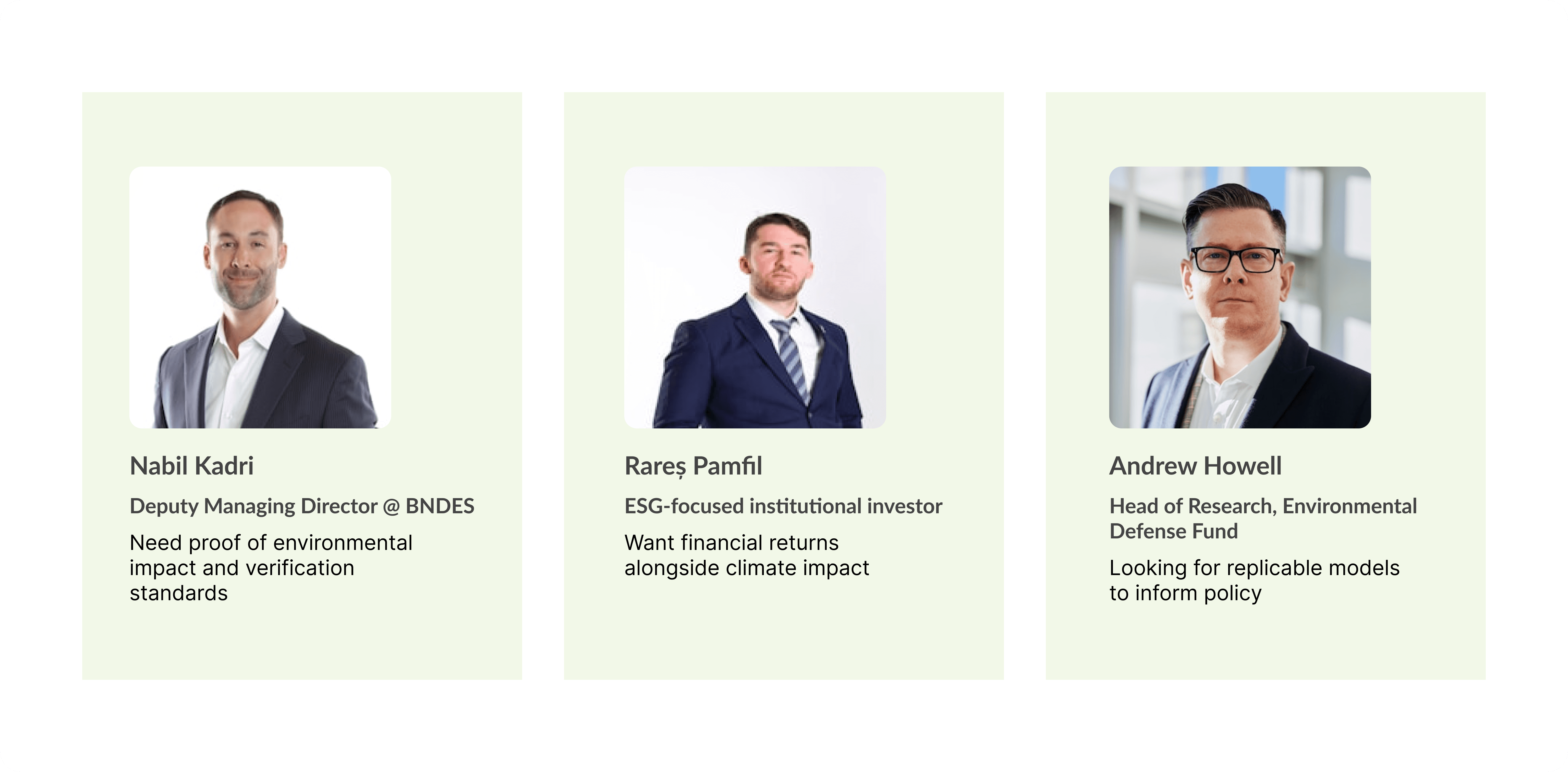

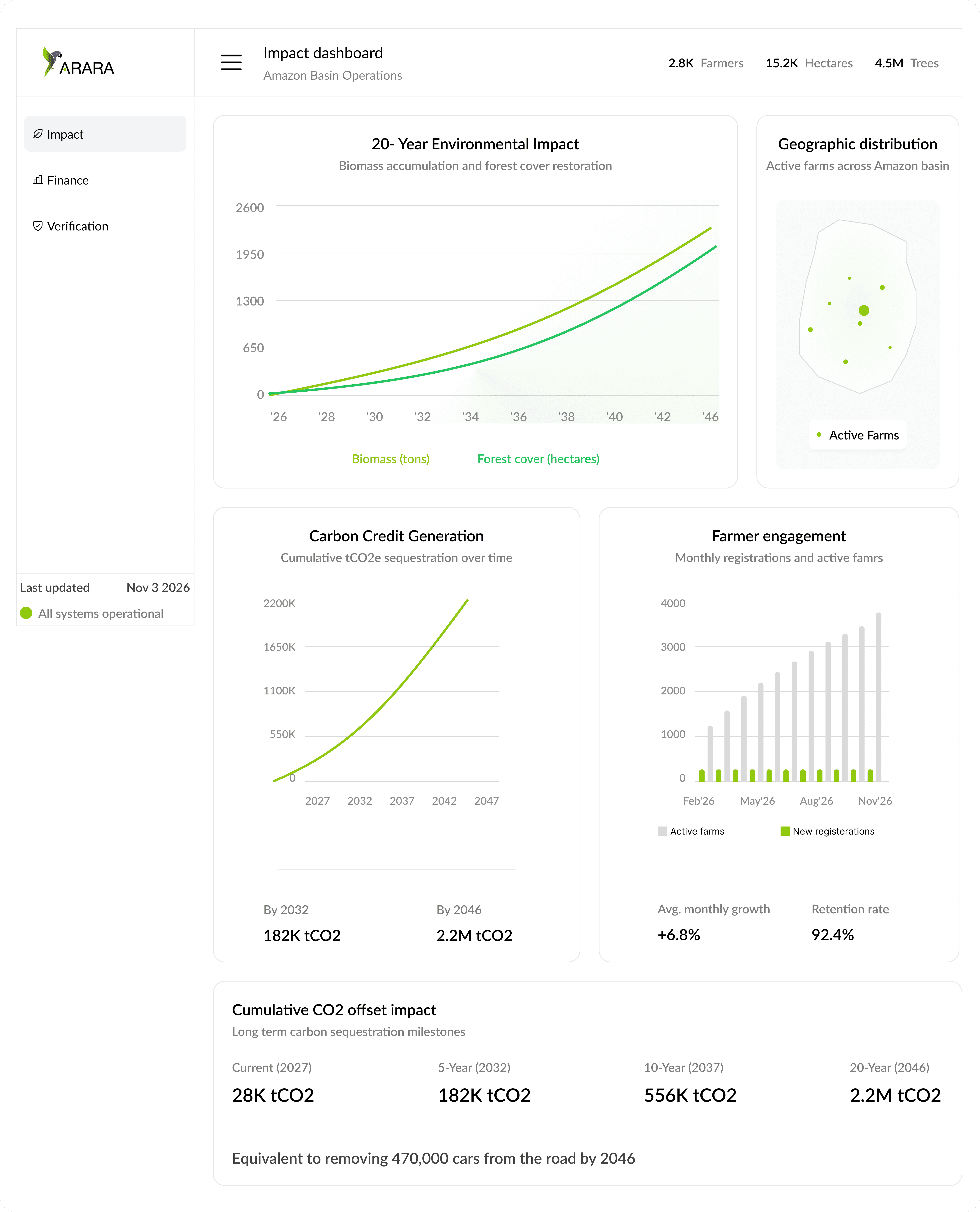

Investors scan before they read → Put impressive numbers upfront (2.8K farmers, 4.5M trees)

These insights gave me a clear direction on what information to present - striking the right balance between giving investors a clear overview while avoiding information overload. I further deepened my understanding by collaborating with Sylvi, a platform that provides insights on MRV, and researching what an effective MRV pipeline should include and understanding the finances along with identifying the key impact metrics and financial metrics that are essential for informed decision-making.

Challenge: Investors evaluate projects on long-term climate impact, not just current status.

Solution: Dual-metric line chart showing biomass accumulation and forest cover restoration reaching 2.2M tons CO₂ by 2046.

Impact: Positions ARARA as a long-term climate solution with compounding returns—aligned with COP30's 2030 and 2050 climate targets.

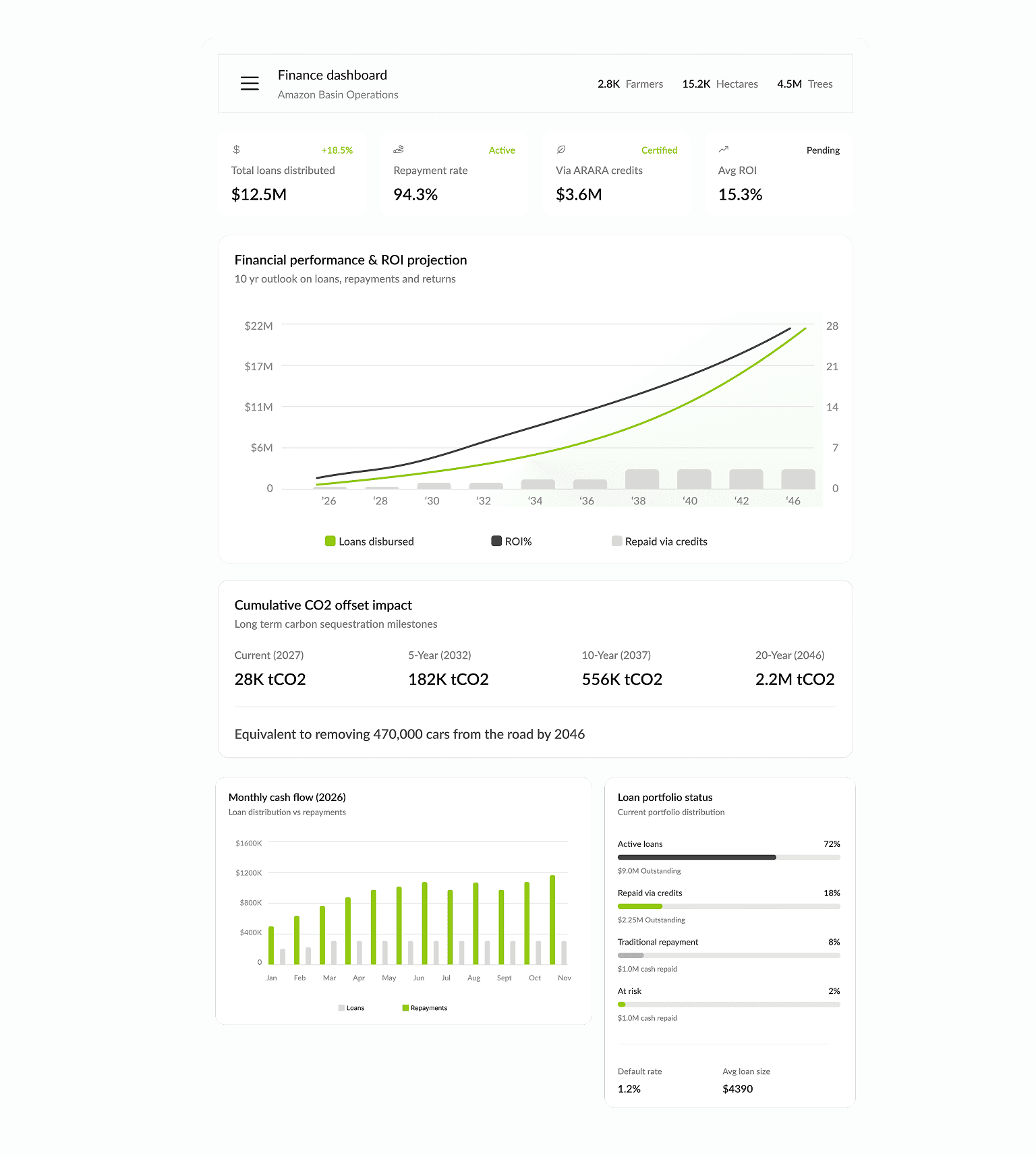

Finance Dashboard

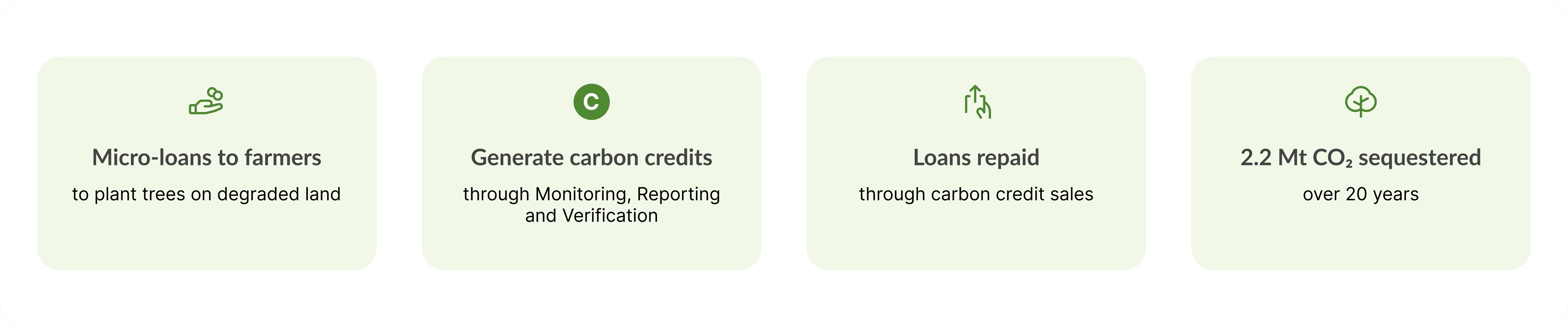

Challenge: ARARA's hybrid model (loan interest + carbon credits) was hard to explain.

Solution: Multi-layer chart showing loans disbursed, ROI growth, and carbon credit repayments over 12 years.

Key metrics: $12.5M loans, 94.3% repayment rate, 15.3% ROI

Impact: Makes the financing model immediately clear - addresses COP30's core question: "How do we fund climate action sustainably?"

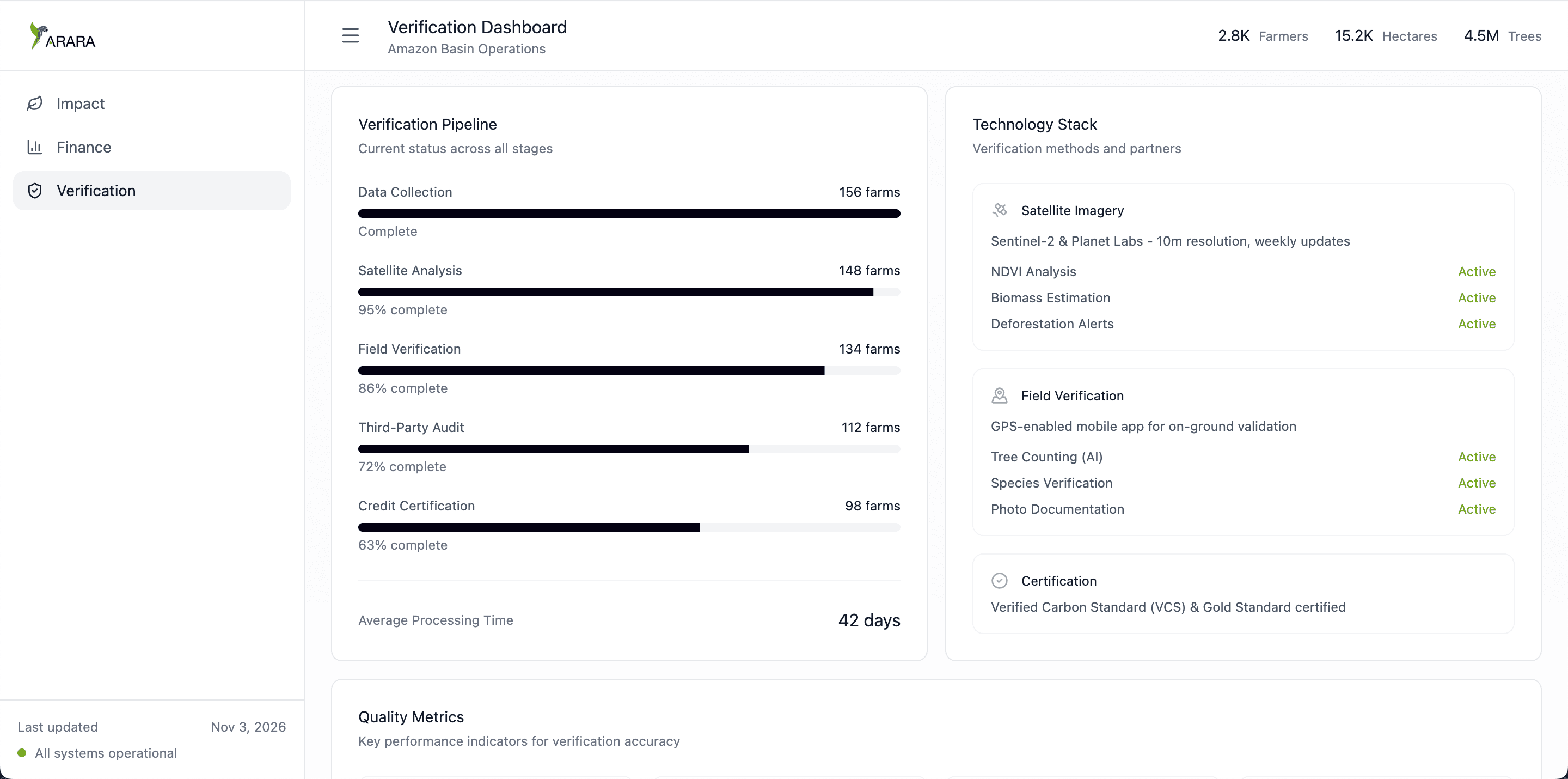

Verification Dashboard

MRV Pipeline Transparency

Challenge: Prove verification rigor to counter greenwashing concerns.

Solution: Five-stage pipeline with real-time completion rates showing satellite analysis (95%), field verification (86%), third-party audits (72%), and certification (63%).

Impact: Builds credibility by making verification visible-directly addresses trust issues in carbon markets.